Do you want to do crypto future trading in Japan and don't know how? Today I will show you one of the best guides but also at the end of the article I will give you free lessons on how to do future trading step by step from an excellent trader.

Let's go straight to the how-to guide Future trading In Japan

Table of Contents

Choosing a Platform for Crypto Future Trading

Initially, the first step you need to take is to register on a leading cryptocurrency exchange that has several future pairs. After much research the Bybit exchange is one of the best for what we are looking for.

How to register on the Bybit exchange

To register at Bybit exchange the process is very easy

- Create Account: you will register on the Bybit exchange from here www.bybit.com and you will pass a quick verification (KYC)

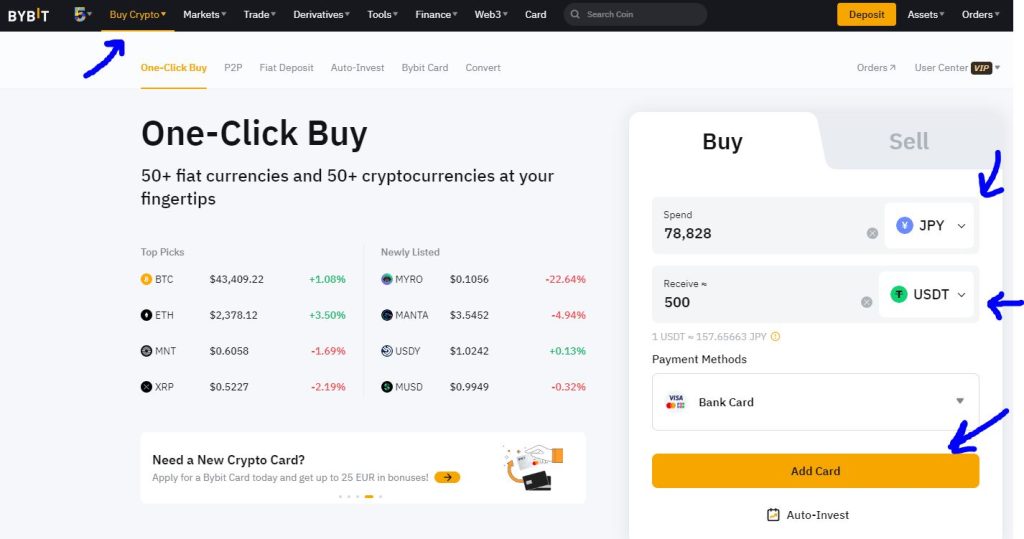

- Deposit to Bybit: You will go to class Buy crypto you will select the local currency JPY and buy USDT. you will put on your card which other option suits you.

How to do Crypto Future Trading in Japan

As soon as the usdt arrives in your account, you will fly the category Derivatives / and after USDT perpetual, You will be taken to the Bitcoin chart page.

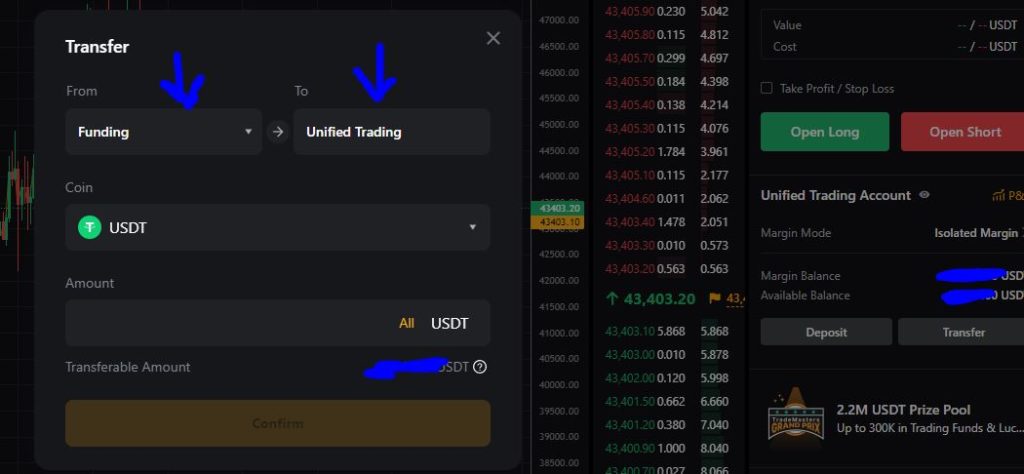

Then you have to transfer them Cryptocurrencies that you buy in the future category. To do this you will go to the selection Transfer and you will transfer from Funding into a Unified Trading

Now that the money has appeared let's go get our first transaction.

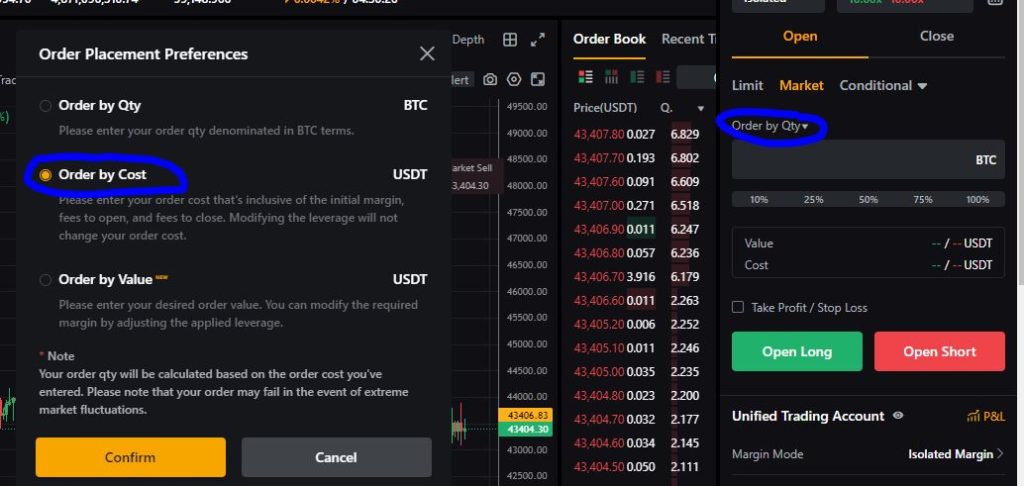

The first step you should press click on qty and select it order by cost.

In the example I will show you now I will take a buy future transaction in Bitcoin.

However let's see what you need to know to get a trade.

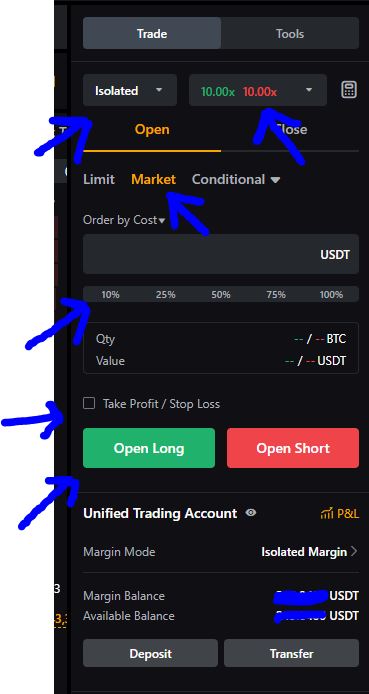

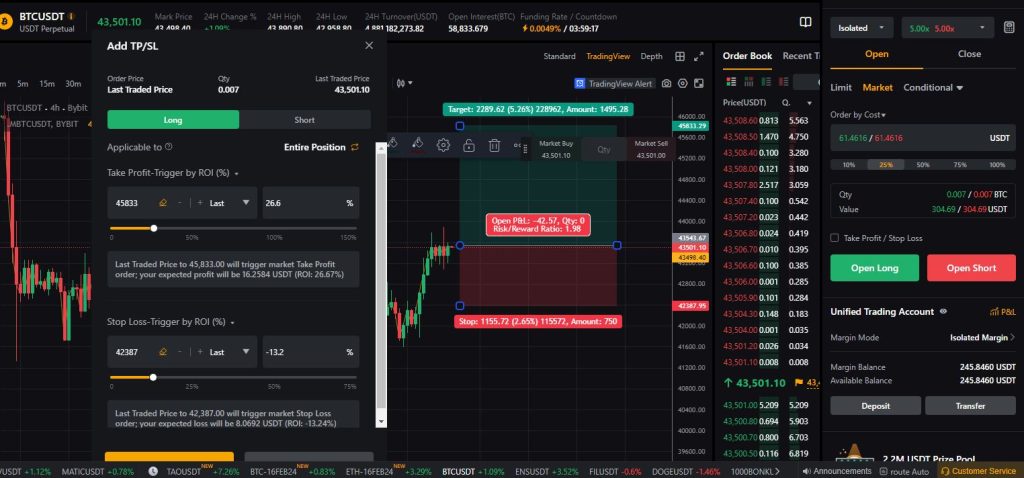

- Isolated: All the trades you get will always be in isolated

- Leverage: Leverage should be below 6x for a beginner, however it is up to you what leverage you choose.

- Limit: The limit option is when we want to buy at a better price automatically or sell at a better price automatically.

- Marketplace: The market option is when you want to buy or sell directly.

- Order by cost: Here you will put the money to buy or sell a transaction.

- Take profit/Stop Loss: Take profit & stop loss is the process that will stop automatically so that we don't lose or win anymore.

I in my trade believe that it will bitcoin it will go up, so I will take the transaction long buy

- Isolated: ✅

- Leverage: x5

- Limit:❌

- Marketplace: ✅

- Order by cost: 25%

- Take profit/Stop Loss: In take profit I will gain 15 usdt if the price goes to 45833 but if I am wrong and the price goes to 42387$ then the trade will be closed with a loss of 7,68 usdt.

Just press open long will get you the transaction at positions

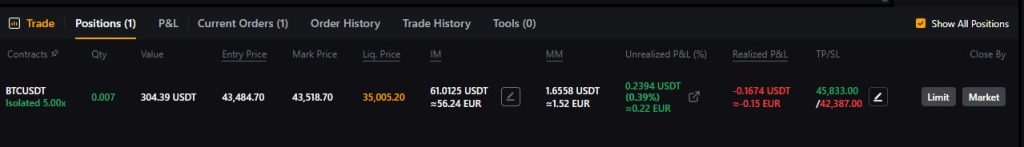

- contracts: is the currency we will have chosen.

- Qty: is the value in btc of the position we have taken.

- Value: is the leveraged value we got in usdt

- Entry price: The price at which you opened your position.

- Liq. Price: it should always be greater than the slop loss you have set because if it is less than the stop loss your position will be closed at this number

- IM The actual position we have opened.

- p&l: the profit and loss we will have on a trade

- TP/SL: it will tell you where you have set the stop loss and take profit

LIABILITY DISCLAIMER:

Cryptocurrency trading is VERY risky. Make sure you understand these risks if you are a beginner. The Information in the post is my OPINION and not financial advice. You are responsible for what you do with your money

Affiliate Disclaimer:

The above links to the services mentioned may be affiliate links. If you use the service through them then you help the BitsounisProject to continue to exist, at no extra cost to you.

Follow it Bitsounisproject.com on Google News to be the first to learn the latest news about Cryptocurrencies, Shares and new projects. Follow us on, Twitter, and TikTok.