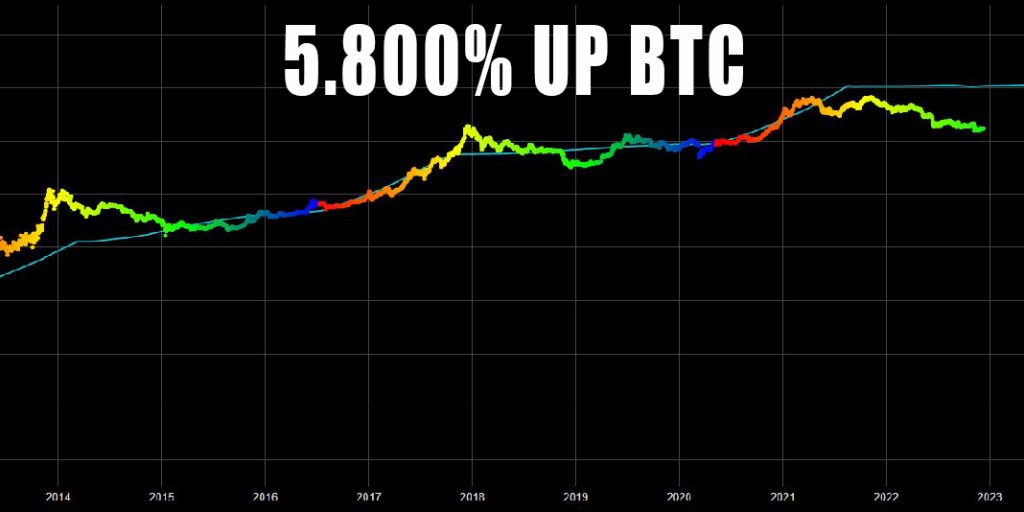

PlanB – the pseudonymous analyst behind the famous Bitcoin (BTC) stock-to-flow (S2F) model – expects that Bitcoin could soon see a 5.800% rally.

During a recent interview , PlanB suggested that Bitcoin could be headed significantly higher and that its stock-in-flow model has yet to be invalidated. He said:

“Assuming the old model, the entry-level 2019 model is correct, the $55.000 model, then the next half could lead to prices somewhere — and I do a very wide range, some people don't like — but somewhere between 100.000 and $1 million." PlanB, a crypto analyst

PlanB went so far as to say that it is confident the prediction will hold unless its model is completely invalidated or "Bitcoin dies." He emphasized:

“I have no doubt we're going into that $100.000 — $1 million range, and no matter how you look at it, the current price is a steal, if that's what you think. So yes, I'm very optimistic.” PlanB, crypto analyst

Speaking of the short term, PlanB suggested that Bitcoin will likely bottom out in the ongoing bear market in the coming months.

What is 99bitcoin | List of so-called Bitcoin deaths

The stock-to-flow model is a type of economic quantitative model that prices commodities based on the total existing supply (stock) and the new supply created at a given time (flow.) In the case of Bitcoin, the current supply is the stock, and newly mined Bitcoin is the stream.

Bitcoin halvings are pre-programmed events that cut the mining rate of new Bitcoin in half, reducing the BTC mining rewards for each new block by 50%. The half percentages have a large effect on the price prediction of this model. Looking at the 463-day version of the model, which "smooths out" price increases after halving the average, we can see that the model has predicted Bitcoin's performance to an impressive degree.

Many claimed that the latest bear market was canceling Bitcoin stock-to-flow. Others reported that the coin's price had ventured further away from the model's prediction than at any other time. However, looking at it chart diversion stock in stream available on the Glassnode blockchain data service, we can observe that the last statement is not true.

The chart clearly shows that Bitcoin is currently worth less than 15,3% of what the stock-to-flow suggests it should be. However, during the bull market of 2011, the price was worth almost 40 times more than the model estimated its value. The price was much further away from S2F estimates before than it is now, it just never went negative.